South of the border

23 April 2021Latin America is large and diverse. As Julian Champkin discovers, its market for lifting gear is recovering from the pandemic.

Each country in Central and South America is different,” says Juan Jose Padilla, international sales manager for Harrington Hoists.

“Each has its own regulations, economies and rules; and although it is a convenient term, in reality Latin America cannot be defined as just one big common region.”

Thus, Mexico’s international trade, he says, is dominated mostly by manufacturing. “It participated in the recently signed USMCA (US-Mexico- Canada agreement) and sends its manufactured goods to the US and Canada. Chile on the other hand is more of a mining-based economy. The upper Central American triangle is agricultural rather than industrial, and the “northern” South American countries such as Ecuador, Peru and Colombia are a mix of both mining and industrial economies. Panama relies heavily on the Panama Canal and Free Trade transport while Costa Rica relies heavily in tourism, some mining and very light manufacturing.”

Pere Garcia, director general of GH Cranes Mexico, also finds the Mexican market differs significantly from the others.

“Since the change of Government in 2019 in Mexico, the economy of the country has gone down. Government investment in industry has decreased and large public projects were stopped. Foreign investment has decreased or simply disappeared. 2020 seemed to get off to a better start, but in March came Covid-19.

“The rest of the year was very difficult. Our sales were affected. Important sectors like construction and energy were really damaged. The automotive sector also suffered, but not as badly since most autopart fabrication in Mexico is for export to the US.”

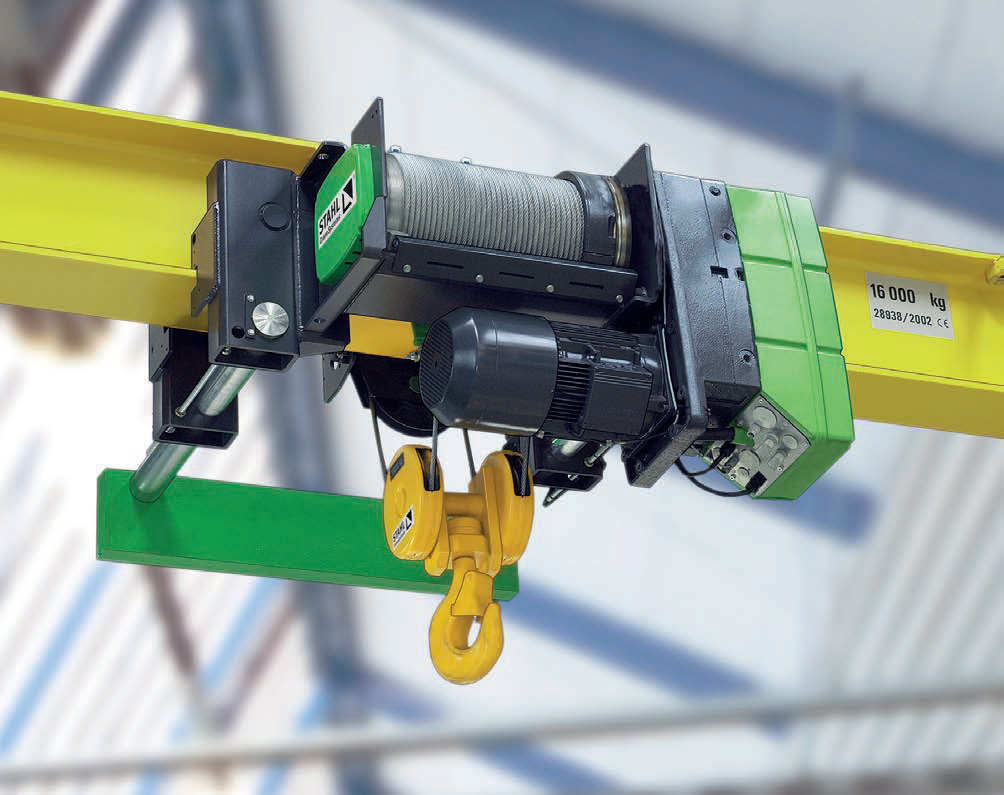

“Countries in Latin America have been evolving at different rates,” says Karsten Hönack, STAHL CraneSystems regional sales manager for Latin America. “The development of free trade agreements has been positive for the region. One is the latest ‘Trans-Pacific Partnership’, which is expected to provide greater stability on the west coast of South America. Stahl is a Columbus McKinnon brand, and the partnership has been benefitting from such agreements. “For example, we completed a project in Columbia in mines up to 4,000 meters above sea level.”

The various countries are also influenced by the key vertical markets that drive their economies, says Oseir Garcia Andrade, Latin America marketing manager of Columbus McKinnon. “In Mexico, automotive plays a key role, as do oil and gas. Peru and Chile are highly dependent on mining. In Colombia, power generation is a key vertical market while Argentina is highly dependent on chemical processing.”

Yosu Ezpeleta, commercial director of GH Cranes for the Andes region, agrees: “Peru and Colombia are countries that are very different from each other. In Peru, industry is highly centralised in Lima and essentially involves mining. Larger capacity cranes are therefore needed.

Colombia is more complex because the industry is more diverse and is spread over different cities - Bogotá, Medellín, Cali and Barranquilla are the main ones - and the cranes in general are of low capacity.

In Ecuador, we are involved in mining and cement projects, and also, through our distributor, on the new Quito Metro, both in the civil works and in the train workshop yard. And in Bolivia we are working through distributors in the energy, cement and sugar processing sectors.”

So Latin America as a term is a bit of a catch-all. It does though have historical and cultural meaning: past links with Portugal and Spain still have their influence today, as Ezpeleta points out: “The South American market is very attractive for us: the cultural affinity with the Andean countries makes us, as a Spanish company, feel at home.

That’s why GH is committed to increasing its presence with its own subsidiaries in Peru, Colombia and Brazil, and distributors in Bolivia, Ecuador, Argentina and Chile.”

Even so, it has not been easy. “At first, GH was relatively unknown in the Andean Community and for that reason we proposed new strategies to improve our position in the market. We set up a subsidiary in Peru, followed by another in Colombia. The key in those early days was to find the right people locally to win contracts in important projects for prestigious companies. That opened many doors for us.”

Even with those advantages, it is not an easy continent to work in. “In general,” says Ezpeleta, “access to certain resources in South America is not like in other countries, and this means that decision-making takes longer and our growth in the market is slower.”

Which makes, perhaps, for slower uptake of the newest technologies or harder work in selling their virtues: “For this reason, it is very important to be able to explain our technical strengths and added values to our customers,” he says. “Variable frequency drives in all movements, and our ‘Corebox’ system for the recording of loads and SWP of the machine are features that are included as standard. We have to demonstrate the advantages of these with facts, to show that, although the competition may offer slightly cheaper products, on many occasions these do not really satisfy the customer’s requirements. The purchase of these machines should be seen by our customers as a long-term investment, giving more safety, productivity, fewer unexpected stoppages, and savings in spare parts and maintenance.” The efforts do seem to pay off: “Many customers have seen the advantages of working with a high added value product and that in the long term, the product will offer them outstanding results.”

Jaso is another Spanish company with strength in the region. It too has further ambitions: “Despite the current worldwide situation we are continuing with our expansion plans in South America, improving the facilities and adding considerably more staff at our production centres in Argentina and Mexico,” says Alvaro Arratibel, who works in their marketing department. “The sugar industry, mining, energy sector and water treatment sector are areas which we have noticed are not suffering a lot from the pandemic.” As for demand for technology, “the specifications that our customers look for are very similar to European demands, in speeds, capacities, technology and so on, but our standard solutions for kit cranes and hoists are very competitively priced, and that is appreciated in the region.”

And innovations are not being neglected: “Similarly, we are seeing a bigger demand for our AGV’s [Automated Guided Vehicles] in Europe: it is a mature product with optimized technology which offers many solutions. So, we are promoting this product also in Latin America. It is very easy to transport and is the best solution for moving heavy equipment at ground level both indoors and outdoors, without limitations of rail length and distance.

They bear heavy loads and can be self-propelled and battery powered or manually controlled.”

“There have been pockets of moderate strength in sectors such as telecom, construction, and pharmaceuticals” say CM’s Garcia. “The healthcare industry experienced a boost with the pandemic.

In Brazil, energy transmission and wind energy have been doing well. As the rest of the world returns to growth, industries that seem to have potential to recover faster than others are mining in Mexico, Peru, Chile, and Brazil; manufacturing in Peru; and metal working in Colombia. Alternative energy, such as hydropower, presents opportunities throughout the region.”

And of course, markets that have been severely challenged globally, such as aerospace and oil and gas, are similarly impacted here as they are elsewhere.”

“The coronavirus crisis in 2020 has been quite complicated,” says Ezpeleta of GH, “and six months of lockdown has led to a change in the negotiation model.

Purchasing decisions are months-long processes under normal circumstances, so now they are taking even longer and some crane sales for the year 2021 have actually come to a halt. Since in the current situation it is more difficult to travel and visit customers, we have recently been doing a lot of work in the digital environment and in social media. Also, given that purchases have been delayed, we are carrying out more maintenance services and sales of multi-brand spare parts.”

“Latin America was impacted by the pandemic later in the cycle than most of the world,” says Columbus McKinnon’s Hönack, “and is currently more challenged than North America and Europe. The impact of the pandemic on the countries here has been significant, as you might imagine, given their smaller economies with fewer resources to offset the challenge. There were early indications of a modest recovery, as most of the world has seen, although the region is now (April 2021) facing the wave that most other parts of the world had in December and January. Forecasts are indicating that the recovery could be a two- or three-year process. It is our smallest served geographic market currently, but it has been the most heavily impacted by the pandemic.”

“Chile is probably the country that has managed the pandemic best in Latin America,” says Jose Padilla, international sales manager of Harrington Hoists. “Their economy is a bit more open now than most other South American economies – that was helped in part by an increase in copper pricing in November 2020 - and they have applied more vaccines than any other country in Latin America. Even so they still suffered around 6% contraction in GDP for 2020, due to a very rigid shut down and quarantine conditions for most of the year. Peru and Mexico have been deemed to have managed the Covid pandemic least well. The Mexican government decided against giving incentive packages that would help private businesses and apparently, due to low testing, is still under reporting its Covid numbers while at the same time having one of the highest Covid mortalities in the world. There is also some concern as to how the Mexican Government is managing the economy.

The previous administration, albeit full of alleged corrupt practices, maintained a very friendly environment for foreign direct investment. The current administration is more focused on expanding government control of many aspects of the economy, causing serious concerns that could deter much needed foreign investment. Peru´s government has been marred by turmoil, with forced changes in the Presidency and the dissolution of Congress over the past couple of years, and it has recently gone once again into a full lockdown. Colombia is suffering its worst unemployment in the country´s history and Ecuador has a key presidential election later this year that could determine the direction the country will follow in the next few years.”

There are, he says, bright spots: “There is a saying that says ‘if the US economy sneezes, Mexico catches pneumonia.’

When Covid first started, Mexico’s industries shut down partly because the US economy slowed down or was in lock down. It suffered severely: Mexico´s GDP fell about 8.5% during 2020, its worst drop since 1932. Once the US opened up, business in the export industries became very good, at least for us, especially during the summer months, and is still decent on average now. We have also noticed a rebound in South American sales in the last few months, mostly due to the fact that Chile, Latin America’s most prosperous country, seems to be managing the Covid crisis very well. We expect a nice GDP growth in Chile for 2021. And for Peru, Ecuador, Colombia and the others, we expect sales volumes to go back at least to 2019 pre-Covid levels.

“As a company, during this Covid period we strove to maintain or expand our stock volume, sales force, training, product line and more, which are qualities that we are known for. We should be able to meet and reach their material handling needs,” adds Padilla.

Street Crane is another manufacturer very active in the region. Victor Saucedo is their Latin America account manager. “In 2020, Street Crane experienced a decline in sales, especially during the six months from March through August, due to the pandemic,” he says. “Among the most affected sectors were automotive, general manufacturing, oil and gas and mining industries, mainly in Argentina, Brazil, Chile, Colombia, México and Perú. We started seeing signs of recovery from late July 2020 as capital projects that had been put on hold were slowly reactivated in the last two quarters of the year.”

He too is upbeat for the future: “Our business growth expectations for 2021 are cautious but optimistic, as we continue to see increasing demand for our full range of LX series electric chain hoists and ZX series electric wire rope hoists and crane kits. It is coming from the mining, steel, metalworking, cement, power and construction industries, particularly in México, Colombia and Chile.

“Despite the impact that the pandemic has had on our regional business we have still been able to supply our customers with bespoke solutions for demanding applications. Some projects where we have supplied both standard and special products include Saint Gobain’s flat glass plant in Morelos, Ternium’s steel plants in Nuevo León and Puebla – all of those in Mexico - Anglo American’s copper mining plants in the Chilean region of Valparaíso and Gerfor’s Cundinamarca PVC pipe plant in Colombia.”

“We sold last year one special project of fully automatised cranes for a steel mill in the north of Mexico,” says Garcia of GH Mexico. “Now we are in the middle of another flagship project: two 300-ton cranes for the large 2,600MW HidroItuango Hydroelectric Plant in Columbia,” adds commercial director Ezpeleta. “They are the highest capacity cranes that GH has ever built. The whole team is proud that this has been done here. We are also working on important projects such as the Salitre Wastre water treatment plant in Bogotá, the Quito and Lima metros and the Ivirizu hydroelectric plant in Bolivia, as well as steelworks and mining projects.

“The truth is that we are a region with considerable capacity for growth. There is much to do and we are not lacking in either talent or opportunities.”

His colleague Garcia adds this: “GH Mexico started in this country in 1999, so we have been more than 20 years in this market. 2021 will be better than 2019 and 2020. We believe in Mexico and we are absolutely sure that in the near future business will be strong again.” He was speaking of one country; but the sentiments are valid, not only for Mexico, but probably for the continent as well.